Roth Ira Limits 2025 Income Brackets. Roth ira income limits for 2025. 2025 and 2024 roth ira income limits.

Roth ira income limits were adjusted for inflation for tax year 2025. The maximum amount you can contribute to a roth ira for 2025 is $7,000 if you’re younger than age 50.

Roth Ira Limits 2025 Income Brackets Images References :

Source: richardhart.pages.dev

Source: richardhart.pages.dev

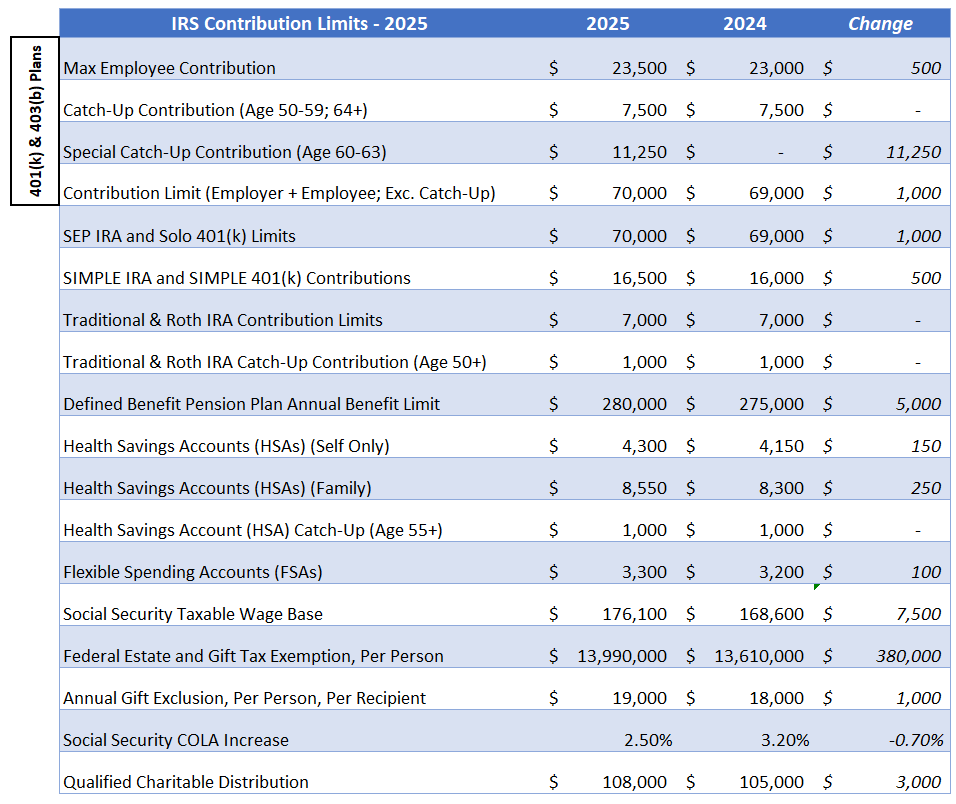

Roth Ira Contribution Limits 2025 Irs Richard D. Hart, In 2025, the contribution limits for both traditional and.

Source: deniceaseantonina.pages.dev

Source: deniceaseantonina.pages.dev

Ira Limits 2025 Roth Contribution Limits Korie Mildred, The roth ira contribution limits for 2025 are $7,000, or $8,000 if you're 50 or older, unchanged from 2024.

Source: vandavcassandry.pages.dev

Source: vandavcassandry.pages.dev

Roth 401 K Limits 2025 Tally Felicity, Irs announces 2025 401(k), 403(b), ira, roth ira contribution limits and income eligibility.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, 2025 and 2024 roth ira income limits.

Source: shehbaazkasey.blogspot.com

Source: shehbaazkasey.blogspot.com

Roth ira limit calculator ShehbaazKasey, Here's a rundown of the 2024 and 2025 roth ira income and contribution limits based on your filing status and modified adjusted gross income (magi):

Source: alexanderforsyth.pages.dev

Source: alexanderforsyth.pages.dev

Roth Contribution Limits 2025 Limit Alexander Forsyth, Hsa, fsa, estate and gifting limits, and more.

Source: lisebzorana.pages.dev

Source: lisebzorana.pages.dev

Roth Contribution Limits 2024 Tax Vicky Marian, However, keep in mind that your eligibility to contribute to a roth ira is based on your income level.

Source: shariqtabatha.pages.dev

Source: shariqtabatha.pages.dev

Tax Deductible Ira Limits 2024 Sandi Cordelie, In 2025, the contribution limits for both traditional and.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021 2025, See the chart below for a summary of the new income limits.

Source: cecilyestelle.pages.dev

Source: cecilyestelle.pages.dev

Traditional Ira Contribution Limits 2025 Nydia Jaquelin, For 2025, the total contribution limit to roth iras remains $7,000, unchanged from 2024, according to the irs’.